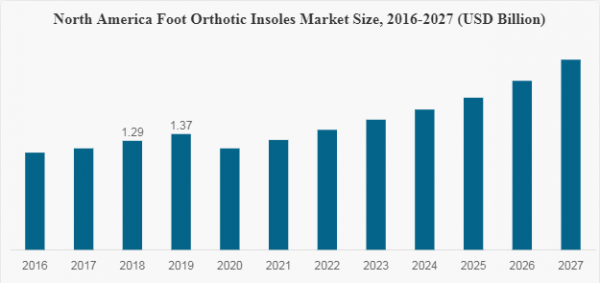

In 2019, the global market for foot orthotic insoles was worth $3.25 billion, which is about the same as it was in 2018. COVID-19 has had a huge impact on the world, and foot orthotic insoles have seen a drop in demand across all parts of the world because of the pandemic. Based on our research, the market will fall by -8.3% in 2020. At a 6.1% rate, the market is expected to grow from a value of USD 2.98 billion in 2020 to USD 4.50 billion in 2027. When the pandemic is over, demand and growth in this market will rise again, and the CAGR will rise quickly.

Foot orthotic insoles are shoe inserts that are made to correct and stabilize the foot’s biomechanical misalignment. They are meant to help people who have foot deformities. Many patients are now wearing orthotic insoles that are specially made for them. These insoles help them be more comfortable in their daily lives and lessen their pain. The number of people who have chronic pain because of a variety of health problems is rising, which is increasing the demand for insoles.

Adults who have diabetes are more likely to have foot pain. According to the International Diabetes Federation, about 463 million people in the world have diabetes in 2019. This is a good thing to do. As well, the use of 3D scanners by manufacturers who can make custom foot insoles in less time is also boosting the market for them.

Putting off orthotics appointments during COVID-19 will hurt the market’s growth.

The COVID-19 pandemic has caused havoc all over the world. It has had a negative effect on the healthcare environment. There are both good and bad things about the pandemic in the medical devices field. This scenario is caused by problems with the supply chain and a big drop in the number of patients in hospitals. As most outpatient appointments are canceled or changed, the number of patients at orthotics and podiatry clinics has dropped. This has hurt the orthotics industry.

Major players in the market have seen a drop in revenue from the orthotic segment because people aren’t buying and there are problems with the supply chain because of the lockdown that was put in place in many countries during the pandemic. For example, Hanger Inc. saw a 15.3% drop in its product and service segments in the first half of 2020 compared to the same time last year. This is also true for ssur. In the first six months of 2020, the company’s bracing and support segment dropped 27% from the same time last year.

However, orthotic clinics that use digital tools like 3D scanners and digital imaging could keep their businesses going during the pandemic, even though many people would be sick. According to a survey of orthotists and prosthetists in June and July 2020, 44 percent of prosthetists and orthotists used digital technology that made it easier for them to give safe care during the COVID-19 pandemic.

RECENT TRENDS

Machine Learning and 3D Scanners should be used more to help the market grow.

Because orthotic foot inserts are becoming more popular, the companies that make them adapt to new technologies so they can better help their customers. Using artificial intelligence and machine learning tools is becoming more important to many businesses. AI-powered sensors can collect data from patients to figure out how foot insoles affect them. Many start-ups, like Shapecrunch and Andiamo, are using big data and machine learning tools to make the best insoles in the world.

THINGS THAT DRIVE YOU

To help the market grow, more people are getting chronic foot problems.

Prescription foot insoles can help people with diabetes, plantar fasciitis, bursitis, and arthritis feel better by reducing pain caused by these and other medical conditions, like arthritis. More than 30% of the general population has pain in their feet. A report from the National Center for Biotechnology Information says the number of people who have diabetic foot ulcers every year is between 9.1 million and 26.1 million people. It is also thought that about 20% to 25% of people with diabetes will get diabetic foot ulcers during their lifetime. Thus, the number of people who have long-term foot problems is a big reason why the market for foot orthotic insoles is growing.

Plantar fasciitis is one of the most common causes of heel pain in people who are old. Thus, the high number of people with the disorder will show that the market is going to grow. There are more than 800,000 people under the age of 65 who go to the doctor for plantar fasciitis every year, according to the American Academy of Family Physicians. Because of this, the market should grow.

Clinical studies show that orthotic foot inserts can help the market grow.

Market growth will be bolstered by a growing focus on clinical studies to see how well foot inserts work for people with a number of long-term foot problems. The National Institute of Arthritis and Musculoskeletal and Skin Diseases (NIAMS) helped Rush University Medical Center start a clinical trial in 2016. The goal of the study was to see if custom-made shoe inserts could help people with knee osteoarthritis control and relieve their pain.

Also in 2019, according to the BMJ Journal, a multi-center, randomized, controlled feasibility study to see if a new, instant-optimized insole for people with diabetic neuropathy is better than a standard insole was started in the US to see if this new insole is better than a standard insole.

The number of clinical studies that show these insoles help people with foot and ankle pain is rising. This encourages more people to use them.

RESTRICTING THE FACTORS

Market growth will be slowed by the presence of alternative therapies.

The fact that acupuncture and other stimulation devices can be used to treat chronic foot problems is likely to slow down the market’s growth. Electrical stimulation devices, on the other hand, are linked to shorter recovery times. This is because orthotic insoles can take months to relieve pain. Plantar fasciitis can be treated with non-invasive physical therapy modalities, shock-wave therapy, and injections of steroids or platelet-rich plasma. Insoles aren’t as good as they used to be. This is likely to slow down the market’s growth.

People in lower-income countries aren’t aware of the benefits of orthotic insoles, and there aren’t enough orthotists and podiatrists in developing countries.

SEGMENTATION

This is how we look at types.

Because People Are Getting More Picky, the Customized Segment Will Take Over the Market.

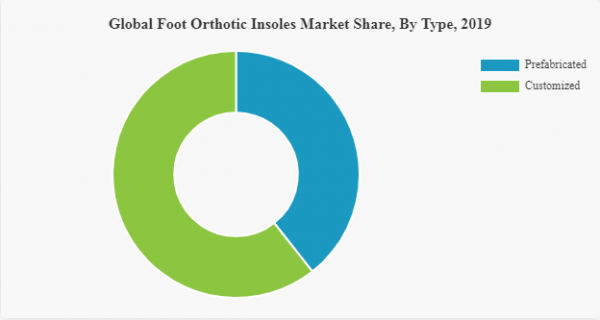

Based on the type of product, the market is divided into prefabricated and customized.

The customized segment is expected to be the most popular in the market during the next few years. Patients prefer orthotic insoles that are made to fit their size and comfort needs. In most cases, orthotists prescribe custom-made foot insoles to improve their patients’ clinical results, but not all of them. This is one of the main reasons why the segment is getting bigger. This isn’t all: 3D foot scanners and moldable clay have made it easier to make custom foot insoles, as well. This is thought to help the growth of the market.

The more people learn about the benefits of foot insoles, new products come out, and the number of people who are older is growing, the prefabricated segment is going to keep growing. Also, the rise in arthritis, obesity, and plantar fasciitis is likely to help the market grow.

By using the analysis,

The medical section will show off the best growth.

Based on what the market is used for, it can be broken down into medical, sports & athletics, and personal.

The medical segment led the market in 2019 and is expected to grow at a very high rate over the next few years. The growing number of clinical studies that show that orthotic insoles can help people with a wide range of illnesses and disorders feel less pain is the main reason why the medical market is so big. According to a study in the journal Archives of Physical Medicine and Rehabilitation, prescription shoe orthotics helped a lot with back pain and other problems. Thus, more studies that show that these products work are likely to make them more popular for medical use.

In the last few years, people have become more concerned about their health and are living healthy lives that involve physical activities like running, walking, and sports, such as walking and running. A pair of over-the-counter foot insoles can be quickly attached to shoes. Many manufacturers are also making shoes that don’t have removable orthotic insoles. This is going to make a lot more people want to buy insoles for sports and athletics that have foot orthotics.

A lot of people use orthotic inserts in their daily lives because they have a lot of benefits. Manufacturers are coming up with insoles that can be used with formal shoes and scandals, and they look good, too. This, in turn, is speeding up the growth of the “personal” market.

When you look at material, you can figure out what is going

Foam Segment to Record the Highest CAGR

Based on the material used, the market can be broken down into thermoplastics, ethyl-vinyl acetate, foam, composite carbon fiber, and other types of goods.

In 2019, the market for ethyl-vinyl acetate (EVA) was the biggest. A lot of people are going to buy these EVA-based orthotic insoles because they’re easy to get, and they’re cheaper than polypropylene foam-based foot insoles.

The use of foot inserts for sports and physical activities is growing quickly, which means there is a lot of demand for good shock-absorbing materials for insoles. As foam-based foot orthotic insoles are good at absorbing shock, they are getting more and more popular. This, in turn, helps the foam segment grow.

Many years ago, these orthotic insoles were made with thermoplastics, like polypropylene, which have been used to make them for many years. Insoles made of thermoplastics also help to reduce plantar pressure, which makes them a popular choice for manufacturers. All of these things are expected to help the market grow.

When you look at how old people are, you can figure out how to

Rising numbers of older people will help the adult group.

Based on the age group, the market can be split into adults and kids.

Adults were the most important group in the market. Diabetes, arthritis, chronic pain, and many other problems are common in old age. In this way, many adults are given foot orthotic insoles. This is the main reason why the adult market has grown. The number of adults who have been diagnosed with arthritis by a doctor is expected to rise from 54 million to 78 million by 2040, the CDC says. This is expected to help the growth of the segment.

Congenital foot deformities are becoming more common, and there are more special insoles for kids like Formthotics. This is expected to help the growth of the pediatrics market.

By analyzing the distribution channels,

The Hospital Pharmacies segment is going to be the biggest part of the market.

In terms of where the products are sold, the market is broken down into hospital pharmacies, retail stores, and online stores.

Healthcare reimbursement for orthotic insoles and the growing popularity of custom-made foot inserts are expected to help the hospital pharmacy market in the next few years. Most of the people who come to the doctor want custom-made foot insoles. The fact that you need a prescription from a doctor to make custom insoles is one of the main reasons why this market is growing so quickly.

Key players like Dr. Scholl, Superfeet Worldwide, Bauerfeind AG, Hanger Inc, Implus LLC, Footbalance Ltd., and others are trying to spread their business around the world by opening stores in different countries. This is expected to help the number of retail stores grow.

Online stores are expected to grow because more people are using over-the-counter orthotics and there are more e-commerce sites.

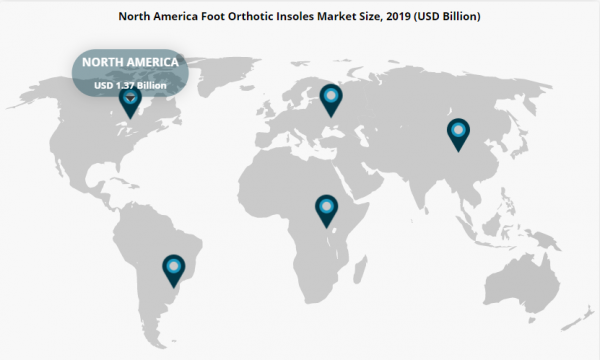

REGIONAL THOUGHTS

There was a lot of money in the market for foot orthotic insoles in North America in 2019. It was worth about $1.37 billion in 2019. The use of 3D printers to make orthotic insoles is growing quickly, and there are more podiatrists and orthotists in the region. This is expected to drive the growth of the market in the region.

The market for orthotic inserts is growing in Europe because of favorable reimbursement policies and government efforts to raise awareness about foot care through awareness initiatives, which are two of the main reasons for the growth of the market. About USD 36.2 million was spent in the UK on orthotic products in 2015 and 2016. This is based on a cross-sectional survey of orthotic service published in BMJ Open. Thus, more money spent on orthotic services and products in Europe is likely to help the market.

Asia Pacific is expected to grow very quickly over the next few years. When compared to other countries, Asian countries like India and China have a lot of people who are old. This is one of the main reasons why the market has grown so much.

The market for foot orthotic insoles is expected to grow around the rest of the world because of more money spent on health care and more people learning about them.

People who work in the industry are important.

Hanger Inc. will be in a good position because it has a lot of customers.

The market is very spread out, with a lot of different national and international players. In terms of market revenue, Hanger Inc. had a good place in the market. In order for the company to stay at the top, it has to work with a lot of healthcare professionals to bring them into its Hanger Clinic network and have a lot of customers. Aetrex Worldwide Inc. is benefiting from strategic collaboration with other businesses in order to grow its global reach.

It is getting more and more competitive because new start-up companies like Tynor Orthotics Pvt. Ltd. Shapecrunch, and A. Algeo Limited are coming into the market with new technologies and getting money from investors. When Tynor Orthotic Pvt. Ltd. got an investment from Lighthouse Funds, a private equity firm, and Thusane in June 2018, the company will be able to grow and meet its goals. This is a list of the companies that have been talked about.

Implus is a company that is owned by a group (North Carolina, U.S.)

Hanger is an American company (Texas, U.S.)

It’s Aetrex Worldwide, Inc. (New Jersey, U.S.)

The company that makes the Footbalance System is called Footbalance System Ltd. (Vantaa, Finland)

An Indian company called Tynor Orthotics Pvt. Ltd is making orthotics (Punjab, India)

In Australia, the company is called Digital Orthotics Laboratories Australia Pty Ltd. (Anstead, Australia)

Thugsne: (Levallois-Perret, France)

Other well-known players

DEVELOPMENTS IN THE INDUSTRY

It was in January 2020 that Digital Orthotics Laboratories Australia Pty Ltd. released the DOLA iPad app. This app can be used with iPad 3D scanners to take 3D scans of your feet so that you can make custom insoles for your feet.

September 2018. Caleres, a global footwear company that makes orthotic shoe inserts and supportive shoes, bought the Vionic Group in September 2018.

There was a private equity firm that bought Tynor Orthotic Pvt. Ltd. for about $21.85 million in June 2018.

COVERAGE OF THE REPORT

An Infographic that shows the market for foot orthotic insoles

The market research report gives an in-depth look at the global market by giving valuable insights, facts, information about the industry, and historical data. Methods and approaches are used to make assumptions and views that make sense. Furthermore, the report gives a detailed analysis of the global market for foot orthotic insoles and information about each market segment. This helps our readers get a clear picture of the global market.

| ATTRIBUTE | DETAILS |

| Study Period | 2016-2027 |

| Base Year | 2019 |

| Forecast Period | 2020-2027 |

| Historical Period | 2016-2018 |

| Unit | Value (USD Billion) |

| Segmentation | Type; Application; Material; Age Group; Distribution Channel and Geography |

| By Type | Prefabricated

Customized |

| By Application | Medical

Sports & Athletics Personal |

| By Material | Thermoplastics

Ethyl-vinyl Acetate (EVA) Foam Composite Carbon Fiber Others |

| By Age Group | Pediatrics

Adults |

| By Distribution Channel | Hospitals Pharmacies

Retail Stores Online Stores |

| By Geography | North America

By Type By Application By Material By Age Group By Distribution Channel By Country

Europe By Type By Application By Material By Age Group By Distribution Channel By Country/Sub-region

Asia Pacific By Type By Application By Material By Age Group By Distribution Channel By Country/Sub-region

Rest of World By Type By Application By Material By Age Group By Distribution Channel

|